Quévillon

Location

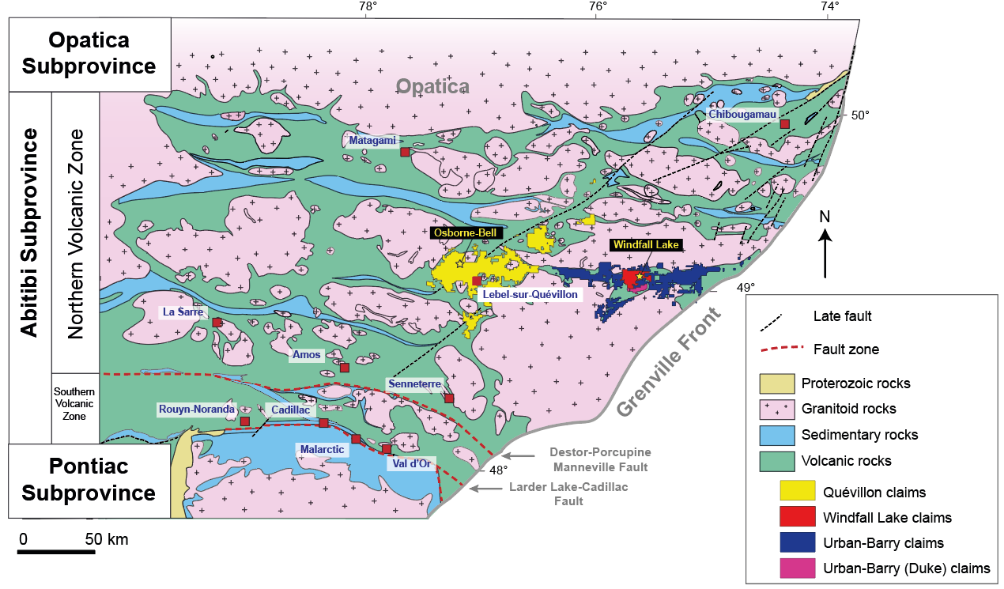

The Quévillon Project consists of 2,573 individual claims covering an area of 138,101 hectares .

The Quevillon Project, located at the boundary between Eeyou Istchee James Bay territory and the Abitibi-Témiscamingue administrative region, can be subdivided into two blocks of claims. The Central Block surrounds the town of Lebel-sur-Quévillon and contains the Osborne-Bell deposit. The northeast block, divided into two sectors, lies to the east of the village of Miquelon.

Access to the Quévillon property can be achieved by headling eastbound from Val-d’Or on the paved Highway 117 for about 30 km, then northbound on the paved Highway 113 for about 125 km where is located the town of Lebel-sur-Quévillon. The Quevillon Project falls within the traditional territory of the Lac Simon Anishnabe First Nation and the Cree First Nation of Waswanipi.

Key facts

Geology

The Quévillon Project is located in the Abitibi Subprovince, in the North Volcanic Zone. The property is mostly characterized by extensive pillowed, massive, or brecciated basaltic sequences intruded by synvolcanic and cogenetic mafic to ultramafic sills and dikes. This mafic volcanic pile is thick, effusive, and generally non-explosive which suggests a submarine basalt plain environment. Few felsic to intermediate volcanic edifices occur within the mafic sequence.

The Quévillon Project is associated with the junction of several major structures, including the Casa Berardi, Laflamme, Rivière Kiask and Cameron shear zones, most of which strike WNW-SE. The Lamarck-Wedding fault borders the northeast block to the north and crosses the central claim block. This deformation corridor has an unusual NE-SW orientation for the area, and truncates the ONO-ESE deformation event in the form of the Cameron Fault.

The area surrounding the Osborne-Bell deposit is part of the Vanier-Dalet-Poirier Group and is dominated by undifferentiated mafic and intermediate volcanic rocks of basaltic to andesitic composition. Felsic volcanics and volcanoclastics of dacitic to rhyolitic composition and interbeds of various sedimentary rocks (argillites, graphitic shales, iron formations) have also been documented. The rocks are metamorphosed to greenschist facies, but may reach amphibolite facies at the edge of late intrusive plutons.

Mineralization

The Osborne-Bell deposit is a disseminated pyrite gold deposit within volcanic units, and is therefore not a typical Archean lode gold deposit like those generally found in the Abitibi belt. Although understanding of the deposit has greatly improved in recent years, the origin of the gold at the Osborne-Bell deposit and its geological controls have yet to be fully elucidated.

Sulphide-rich gold mineralization at the Osborne-Bell deposit extends over a strike length of 1,900 metres; mineralization in the eastern part strikes N276°-N290° and dips steeply (80°) to the north, while mineralization at the western end strikes N310° and dips steeply (72°) to the northeast. Mineralization is up to 430 metres thick and has been traced to a vertical depth of 700 metres below surface in the eastern part of the deposit.

Mineralization consists of disseminated sulphides, sulphide concentrations in the form of millimetric to centimetric lenses, and millimetric veinlets and veinlets of fine-grained sulphides. Sulfides consist mainly of pyrite, with some pyrrhotite, chalcopyrite and sphalerite, as well as gold visible on rare occasions. Higher gold grades are generally associated with the presence of 5-10% sulfides, mainly in the form of sulfide veinlets and veinlets with some chlorite.

Mineralization occurs mainly in synvolcanic felsic units and at contacts with surrounding intermediate to mafic volcanics. Intermediate to mafic volcanic units can also be mineralized up to several dozen meters from contacts with felsic rocks. Gold mineralization is strongly controlled by schistosity within the volcanic units. A swarm of late- to post-tectonic dykes cuts the synvolcanic sequence. High-grade gold intervals are often observed near the contact between volcanic rocks and dykes. The dykes probably played a role in the late- to post-tectonic remobilization of the gold, but are not related to the main mineralizing event that produced the gold.

At the Osborne-Bell deposit, the gold resource is defined within 9 mineralized lenses separated into three sectors (Series 1 to 3). Zones were defined on the basis of a minimum true width of 2 metres and a cut-off grade of 3.0 g/t Au.

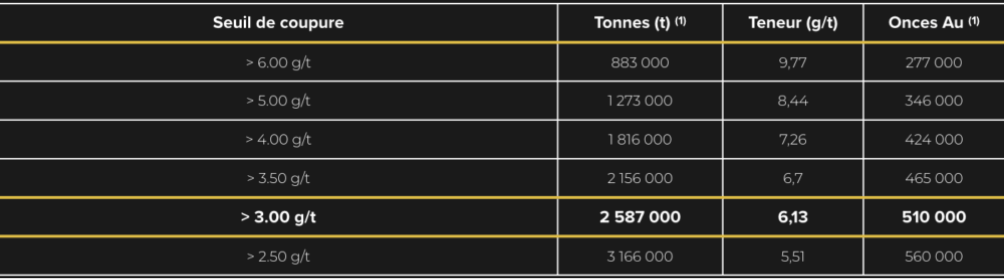

Mineral resource estimation

Inferred Resource: 2.587 Mt at 6.13 g/t Au for 510 000 oz Au assuming US$1,300 per ounce gold price and a lower cut-off grade of 3.0 g/t Au

Notes:

- Values are rounded to nearest thousand which may cause apparent discrepancies.

Osborne-Bell Mineral Resource Estimate notes:

- The Independent and qualified Person for the Mineral Resource Estimate, as defined by NI 43‑101, is Pierre-Luc Richard, P.Geo., M.Sc. (InnovExplo Inc.), and the effective date of the Estimate is March 2, 2018.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability.

- While the results are presented undiluted and in situ, the reported mineral resources are considered to have reasonable prospects for economic extraction.

- The estimate encompasses nine (9) gold-bearing zones each defined by individual wireframes with a minimum true thickness of 2 metres.

- High grade capping was done on composite data and established on a per zone basis for gold. It varies from 25 to 55 g/t.

- Density values were applied on the following lithological basis (g/cm3): volcanic rocks = 2.80; late barren dykes and Beehler stock = 2.78; Zebra felsic unit = 2.72.

- Grade model resource estimation was evaluated from drill holes using an OK interpolation method in a block model (block size = 2.5 x 2.5 x 2.5 m).

- Underground resource estimation is reported at 3.00 g/t Au cut-off. The cut-off calculation is based on following assumptions: Mining cost = C$80; Processing cost = C$40; General and Administration= C$10. For calculating cut-off grades, the following parameters were used: gold price of US$1,300/oz and exchange rate of USD:CAD = 1.29 inspired from the 1-year trailing average. Cut-off grades will have to be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate and mining cost, etc.).

- The Mineral Resources presented herein are categorized as Inferred. The Inferred category is only defined within the areas where drill spacing is less than 100m and shows sufficient geological and grade continuity.

- The resource was estimated using Geovia GEMS 6.8. The estimate is based on 931 surface diamond drill holes. A minimum true thickness of 2.0 m was applied, using the grade of the adjacent material when assayed, or a value of zero when not assayed.

- Calculations used metric units (metres, tonnes and g/t). Metal contents are presented in troy ounces (metric ton x grade / 31.10348).

- The number of metric tons was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations in NI 43‑101.

- The quantity and grade of reported Inferred resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred resources as Indicated or Measured, and it is uncertain if further exploration will result in upgrading them to these categories.

- CIM definitions and guidelines for mineral resources have been followed.

- InnovExplo is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issue not reported in the Technical Report, that could materially affect the Mineral Resource Estimate.